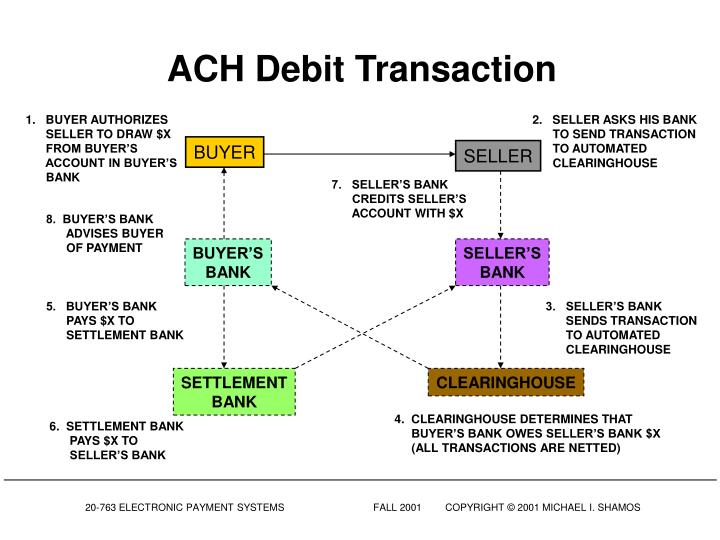

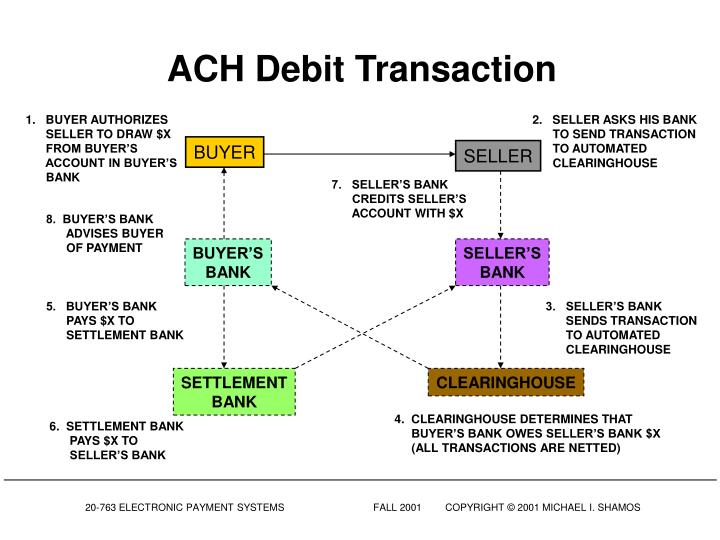

Originator initiates an Entry to push funds into a Receiver’s account. A common ACH credit application is direct deposit of payroll. These functions can include, but are not limited to, creation of ACH files on behalf of an Originator or ODFI or acting as a sending point or receiving point on behalf of an ODFI or RDFI.ĪCH Credits: “Push” of funds from the Originator’s account at the ODFI to the Receiver’s account at the RDFI. Third-Party Service Provider: A Third-Party Service Provider performs various ACH network functions on behalf of Originators, ODFIs, and/or RDFIs.  Third-Party Sender: A Third-Party Sender, a subset of a Third-Party Service Provider, is an entity that transmits ACH Entries on behalf of Originators that have no contractual agreement with the ODFI. Receiving Depository Financial Institution (RDFI): A participating financial institution that receives ACH Entries from the ACH Operator and posts them to the account of its Receivers. Receiver: A consumer, corporation or entity that has authorized an Originator to initiate an ACH Entry to the Receiver’s account with the RDFI. The ODFI receives ACH Entries from Originators and forwards those entries to the ACH Operator. There is an agreement between the Originator and ODFI that binds them to the Nacha Rules. Originating Depository Financial Institution (ODFI): A participating financial institution that receives the payment instructions from an Originator and forwards the Entries to the ACH Operator. The Originator will obtain authorization from the Receiver to transact against their account. Originator: A consumer, business or entity that agrees to initiate transactions into the payment system according to an arrangement with a Receiver. The two operators exchange files between each other as well. There are two ACH Operators: the Federal Reserve Bank and the Electronic Payments Network (The Clearing House).

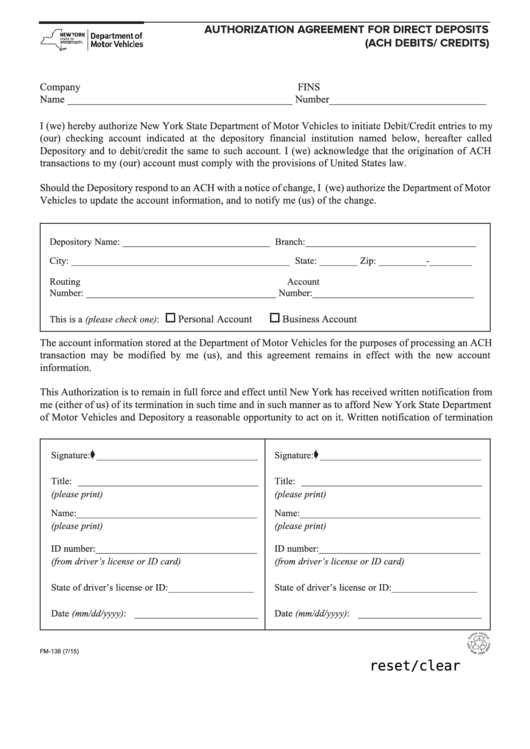

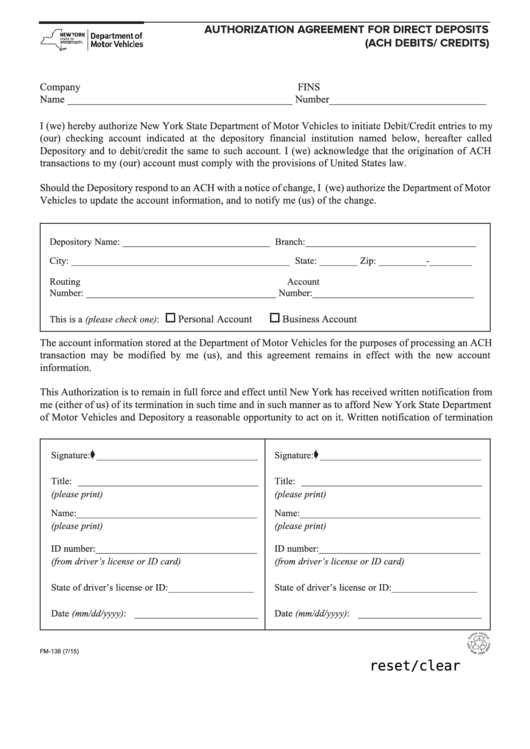

Third-Party Sender: A Third-Party Sender, a subset of a Third-Party Service Provider, is an entity that transmits ACH Entries on behalf of Originators that have no contractual agreement with the ODFI. Receiving Depository Financial Institution (RDFI): A participating financial institution that receives ACH Entries from the ACH Operator and posts them to the account of its Receivers. Receiver: A consumer, corporation or entity that has authorized an Originator to initiate an ACH Entry to the Receiver’s account with the RDFI. The ODFI receives ACH Entries from Originators and forwards those entries to the ACH Operator. There is an agreement between the Originator and ODFI that binds them to the Nacha Rules. Originating Depository Financial Institution (ODFI): A participating financial institution that receives the payment instructions from an Originator and forwards the Entries to the ACH Operator. The Originator will obtain authorization from the Receiver to transact against their account. Originator: A consumer, business or entity that agrees to initiate transactions into the payment system according to an arrangement with a Receiver. The two operators exchange files between each other as well. There are two ACH Operators: the Federal Reserve Bank and the Electronic Payments Network (The Clearing House).  ACH Operator: A central clearing facility that receives Entries from an ODFI, distributes Entries to the appropriate RDFI, and performs the settlement functions for the financial institutions. Allow bills to be paid on time, eliminating the risk of late payments and avoiding late charges. Eliminate check writing and postage expenses. The advantages of using Direct Payments include its ability to: Automatically pay mortgage, automobile payments and other loans. Make insurance, tax and homeowner association (HOA) payments. Pay businesses for their products and services. Eliminate the possibility of lost or stolen checks.Ī Direct Payment is a debit application that the consumer has granted another party the authority to initiate a debit to the consumer’s account. Reduce the time and cost involved with depositing a paper check. Deliver availability of funds on a timely basis. The advantages of using Direct Deposit include its ability to: Social Security and other government payments. The Rules & Guidelines is an annual publication that provides the legal framework for the Network, as well as guidance on implementing and abiding by the Rules.Ī Direct Deposit is a credit application that transfers funds into a consumer’s account. Nacha encourages all ACH Originators and Third-Party Senders to the Nacha Operating Rules & Guidelines to ensure compliance.

ACH Operator: A central clearing facility that receives Entries from an ODFI, distributes Entries to the appropriate RDFI, and performs the settlement functions for the financial institutions. Allow bills to be paid on time, eliminating the risk of late payments and avoiding late charges. Eliminate check writing and postage expenses. The advantages of using Direct Payments include its ability to: Automatically pay mortgage, automobile payments and other loans. Make insurance, tax and homeowner association (HOA) payments. Pay businesses for their products and services. Eliminate the possibility of lost or stolen checks.Ī Direct Payment is a debit application that the consumer has granted another party the authority to initiate a debit to the consumer’s account. Reduce the time and cost involved with depositing a paper check. Deliver availability of funds on a timely basis. The advantages of using Direct Deposit include its ability to: Social Security and other government payments. The Rules & Guidelines is an annual publication that provides the legal framework for the Network, as well as guidance on implementing and abiding by the Rules.Ī Direct Deposit is a credit application that transfers funds into a consumer’s account. Nacha encourages all ACH Originators and Third-Party Senders to the Nacha Operating Rules & Guidelines to ensure compliance.

ACH transactions can be executed on a same-day basis or be future dated to occur on a specific date.

Most payment networks will only push or pull, but not both. The ACH Network electronically moves funds between accounts for consumer, business and government payments, and is a secure, cost-effective and efficient alternative to the processing of paper checks or wire transfers.ĪCH is unique in its ability to both push and pull funds between various accounts. Nacha manages the development, administration and governance of the ACH Network.ĪCH is a batch process, store-and-forward system that provides for value-dated settlement transactions for both disbursements (credits) and collections (debits). The ACH Network is governed by the Nacha Operating Rules, which determine how funds are disbursed and settled among financial institutions. Established in the 1970s, the ACH Network processes billions of transactions a year, serving millions of businesses and consumers, as well as the federal, state and local governments. The ACH Network is a highly reliable and efficient, batch-oriented electronic funds transfer system that provides clearing and settlement of electronic payments.

0 kommentar(er)

0 kommentar(er)